"Best Practices to Manage Taxes Now and in the Future Panel"

8:00 a.m. - 8:30 a.m. - Continental Breakfast & Registration

8:30 a.m. - 10:30 a.m. - Program

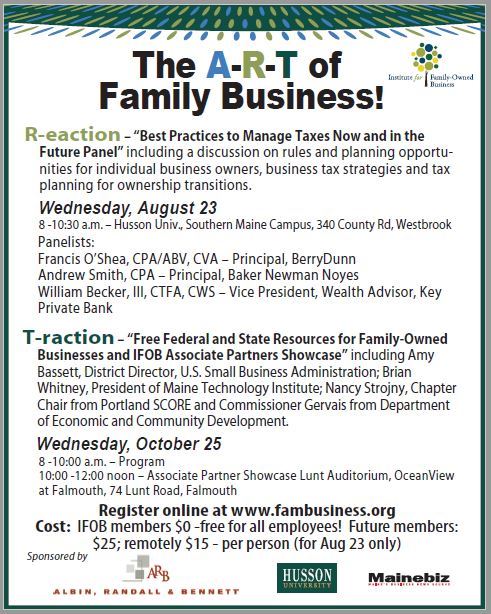

This workshop is the second in our three-part educational series on growing and protecting your family business. This series consists of three seminars/workshops that fall under the umbrella of the “A-R-T of Family Business.” This program will be held at Husson University’s Southern Campus in Westbrook, while the final program will be held at the Lunt Auditorium, OceanView at Falmouth. You can come to all or some of the programs, as each program provides unique topics for discussion. These programs are open to all members and future members of the IFOB!

A - is for "Action" - How to Kick Start Your Succession Plan

R - is for "Reaction" - Best Practices to Manage Taxes Now and in the Future

T - is for "Traction" - SBA Panel Showcasing Federal & State Resources including an IFOB Associate Partner / Members Services Showcase

Reaction – “Best Practices to Manage Taxes Now and in the Future Panel”

Our speakers for this program include Frank O'Shea of BerryDunn, Andrew Smith of Baker Newman Noyes, and William Becker of Key Private Bank.

They will focus on the changing landscape of taxes and how to best manage them, including a discussion of the rules and planning opportunities for:

- Individual business owners

- Business tax strategies

- Tax planning for ownership transitions

Francis J. O’Shea, CPA/ABV, CVA – Principal, BerryDunn

Francis J. O'Shea, CPA/ABV, CVA is a tax principal with the accounting and business consulting firm of BerryDunn. Over his 40 year career, Frank has counseled many closely-held and family business clients on the technical and non-technical issues related to income and estate tax planning, as well as business succession and valuation. Formerly a Principal with Cloudhawk Management Consultants, LLC, and a tax partner with Coopers & Lybrand, LLP, he brings a broad perspective to assisting his clients in successfully developing and implementing tax savings strategies and plans for the transition of their business enterprises. Frank also serves as the Board Treasurer for the IFOB.

Andrew Smith, CPA – Principal, Baker Newman Noyes

Andy began his career at Baker Newman Noyes in 1998, after interning with the firm in 1997. He is a principal in BNN’s tax practice and currently leads the practice’s Multi-Generational Business Group. Andy primarily serves clients in the retail, construction, real estate, and professional service industries. He has extensive experience advising his clients on succession planning, like-kind exchanges, cost segregation studies, and tax credit deals. In addition to serving his clients, Andy leads many of the firm’s college recruiting initiatives. Andy earned a bachelor’s degree in business administration, with concentrations in accounting and finance, from the University of Maine, Orono.

William Becker, III, CTFA, CWS - Vice President, Wealth Advisor - Key Private Bank

William Becker, III, CTFA, CWS - Vice President, Wealth Advisor - Key Private Bank

As a Key Private Bank Wealth Advisor, Bill works with clients to grow, preserve, and protect their wealth through objective advice and strategic financial solutions. Previously a Financial Advisor with Edward Jones Investments, Bill has passed the Series 7, Series 66, and Maine Health and Life Insurance exams and he holds a B.A. in International Business and Economics from University of Mount Union. Active in civic life, Bill has served on the Board of Directors for numerous Maine nonprofits, including the Portland Conservatory of Music and the Pine Tree Council of Boy Scouts, and he is the past president of the Portland Community Chamber of Commerce.

For more information contact: catherine@fambusiness.org

Remote access is available to dial in. You must have hi-speed Internet access and a camera on your computer to connect and dial-in to the forum remotely. If you are dialing in to the workshop you must pre-register so we can send you the remote instructions.

Thank you to our Sponsors: